According to the Article 7-1-2 of the Regulations Governing the Use of Uniform Invoices issued by the Ministry of Finance on July 16, 2018, the business entity (prescribed in Subparagraph 4, Article 6 of the Act) shall issue cloud invoices to purchasers".

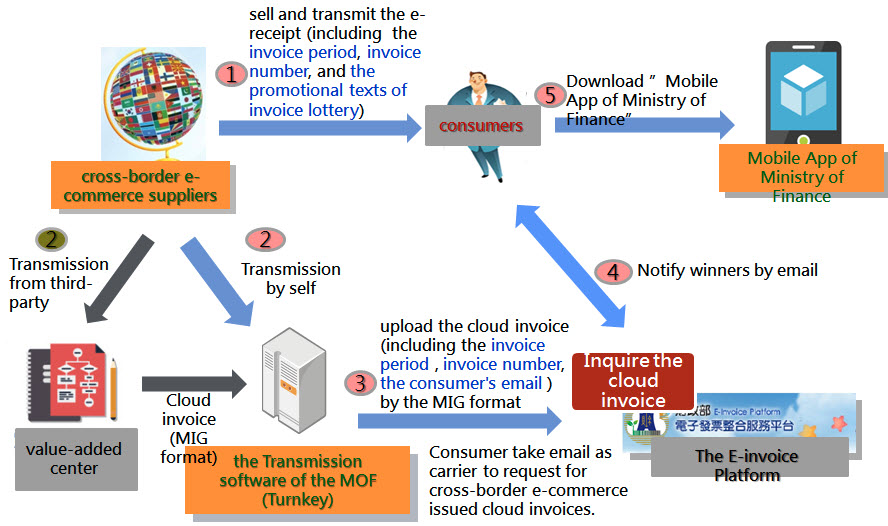

The Cross-border E-commerce Suppliers could assign e-GUI number to issue and upload cloud e-invoices via Value-Added-Center or by building up own Turnkey service the transmission software of Government E-invoice Platform.

Document download of Cross-border E-Commerce Suppliers e-invoicing solution.

Systemlead is the first Value-Added-Center to successfully upload the e-invoice of Taiwan Cross-border E-Commerce Suppliers on 2019/01/02 and earned the approbation of the Government Ministry Taxation Bureau.

Adopt Microsoft AZURE cloud service to meet the high security requirements of the computer room. High availability reliability.Support variety of foreign currency to issue e-invoices, exchange rate for declaration settlement is automatically.Support notification of issued e-invoices and integration of MAIL vehicle services for Cross-border E-Commerce Suppliers.Exclusive implemented consultants and customer service staff to serve in application and completion the e-invoice testing.

The Value-Added-Center Service charge demand on your choice, you can choose the program that suits for you.

The overall cost includes system setting and service fee.

System Setting Service Fee: TWD $ 36,000

+

To purchase the usage quantity year by year to issue e-invoice ,

and add it when is not enough but only could use on current year.

50% discount for the First Import

Exclusive person consultation service

If you do not know how to choose, you can email what you requested directly to the consultation contact window. The consultation contact window is

renee@systemlead.com, we will reply it A.S.AP.

Our systems and data use the AZURE cloud, which complies with ISO 27001 information security standards. And obtained the electronic invoice value center certified by Taiwan's fiscal and taxation government department. The privacy and security of personal data are protected by Taiwan laws and regulations.

EU countries must comply with EU General Data Protection Regulations. After submitting the application, both parties agree to provide personal data format, method and data protection specifications. After agreeing the fees, a GDPR supervision contract can be signed.

Assist in understanding the relevantions and assistance updates for e-invoicing . 24hr online respone.

Assist the customers who use eINV servive could complete the VAT filling by online calculation to generate output VAT media data.

if you have any filling VAT questions, we could introduce you experienced accounting firm.

Company A is belong Coss-Board E-commerce Suppliers , implete e-invoice as required, evaluate the transaction amount.

Anticipate monthly average Taiwan e-invoice to be around 2000 per month, some months hight and some months low , about 240,000 invoices a year.

1.The transaction volume could be satisfied by purchasing the annual contract 120,000 pieces program.(50% OFF)

2.The first time touch Taiwan e-invoice regulations, unfamiliar with e-invoicing related , plus purchase VAT Tax assistance 1 year.

1.einv system Initial construction service fee TWD 30,000

2.Yearly e-invoice service up to 120,000 pieces fee TWD 18,000 (50% OFF)

3.one year assist filling VAT report TWD 36,000

Total amount TWD 84,000

Yearly e-invoice service up to 120,000 pieces fee TWD 36,000

Subtotal TWD 36,000.

We provide three way to issue e-invoice to consumers , one is EXCEL file upload by manual , another is Excel file transfer via SFTP ,and the other is transmission data via API , you can choose any one of them.

Caution : The consumer's EMAIL address must be obtained for notification and consolidation of carry-on e-invoices. .

The document of EXCEL file format for Cross-border E-Commerce Suppliers.

The document of SFTP description for Cross-border E-Commerce Suppliers.

The document of API description for Cross-border E-Commerce Suppliers.

TelPhone: 0800-800-402

Email: SERVICE@SYSTEMLEAD.COM

line:@Systemlead

We also provide the counselling services for building up own e-invoice and Turnkey system.

Related documents of Turmkey service for reference.

(1)Message Implementation Guideline For E-Invoice Data Exchange (MIG)(V4.0) 【Chinese Ver.】 【English Ver.】

(2)The manual of Turnkey for E-Invoice Platform 【Chinese Ver.】 【English Ver.】

(3)Download the Transmission Software Turnkey of Ministry of Finance 【Windows Ver.】【Linux Ver.】

(4)E-Invoice Self-Test before Turnkey Goes Online(V4.7) 【Chinese Ver.】 【English Ver.】